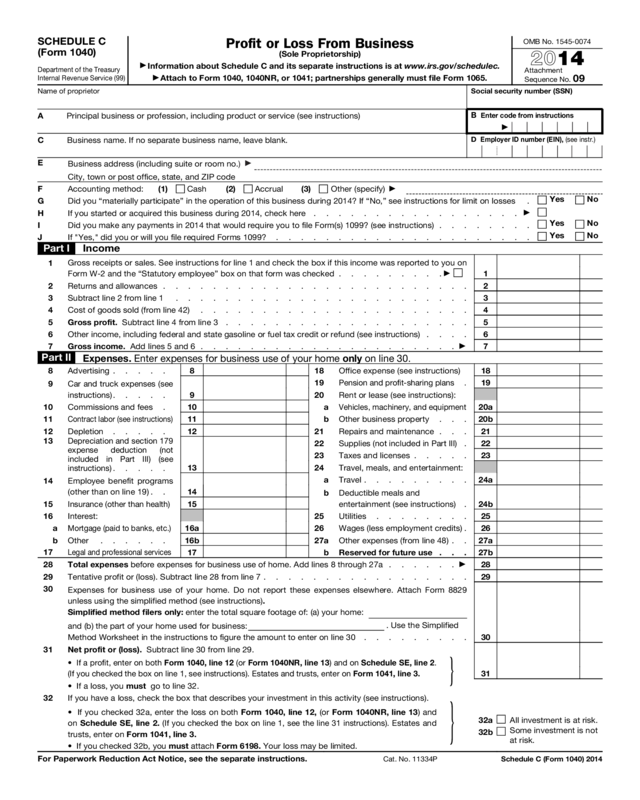

If you are both a sole proprietor and a statutory employee, you’ll need to fill in two Schedule Cs-one for each role. They also use Schedule C, which is why they get a reference here. Statutory employees are independent contractors who are treated as employees, meaning their “employers” withhold taxes. This is your gross income-don’t deduct refunds or returns. Translation: Total income, not including sales tax, goes here. See instructions for Line 1 and check the box if this income was reported to you on Form W-2 and the “statutory employee” box on that form was checked. Lines 3, 5 and 7 can be taken as instructions, but for the rest, here’s a quick translation. This is where Schedule C starts to look less straightforward, and more like a tax form. Social Security Number (SSN): You must enter your SSN, even if you use an EIN for business purposes.

If you answer “Yes” to I, you must also answer “Yes” to J, and file a 1099. I-J: If you paid subcontractors or individuals $600 or more for work in your business, you’ll need to file Form 1099.

H: Check the box if this is your first year in business. If you did, check “Yes.” If you’re unsure, consult an expert. G: “Material participation” generally means if you worked in your business. If you’re not sure which you’re using, check out our guide to the differences between cash and accrual accounting. Usually, small business owners use cash accounting. Potentially confusing boxes include:Ī-B: In Box A, enter a brief one-line description about the type of business you’re doing, and the relevant code (found in the IRS instructions).į: Record your accounting method. Most of this is pretty self-explanatory, requiring basic information like your name and business address. The top part of Schedule C isn’t labeled numerically, but instead has ten separate lettered boxes: A through J. An inventory count and valuation (if you sell products)Īlthough we’re going to walk you through the six sections of Schedule C, you’ll still need the official instructions to find the Principal Activity Code for your business.Receipts or statements for any business purchases-including smaller items, like food expenses, and big-ticket items like equipment, cars, or buildings.Your EIN ( Employer Identification Number)-if you have one.

0 kommentar(er)

0 kommentar(er)